Distributing Excise Tax

EDIT, 6/13/17: On excise tax amounts. Originally in 2014, producers and processors were each taxed 25 percent for a total of 50 percent excise tax to the state. HB 2136 actually decreased the total taxes from 50 to 37 percent and put it entirely on the retail side, according to Will Linn, Senior Vice President of Sales at Northwest Cannabis Solutions.

When I-502 was passed in 2012, the excise tax was 25 percent, and that entire 25 percent went back to the WSLCB and the state. City and county governments got nothing in return for allowing the sale of recreational marijuana within their respective jurisdictions.

Legislators amended the law to make significant changes to the excise tax code. Specifically, House Bill 2136 amended the increase from 25 to 37 percent to account for the city and county’s share, according to the MRSC.

In 2017 and 18, city and county governments aren’t getting money from the actual marijuana excise tax revenue. It’s coming from a separate $12 million that’s allocated from the state budget, per the Association of Washington Cities (AWC.) In 2018, local government’s marijuana excise tax payments will come from actual excise tax revenue.

However, another amendment to HB 2136 set distribution caps on local government’s share. In 2018 and 19, the cities and counties can receive up to $15 million. In 2020, the cap is increased to $20 million, but that’s the final cap, the AWC reports.

Marijuana Excise Tax Pt 2: Distributing Excise Tax

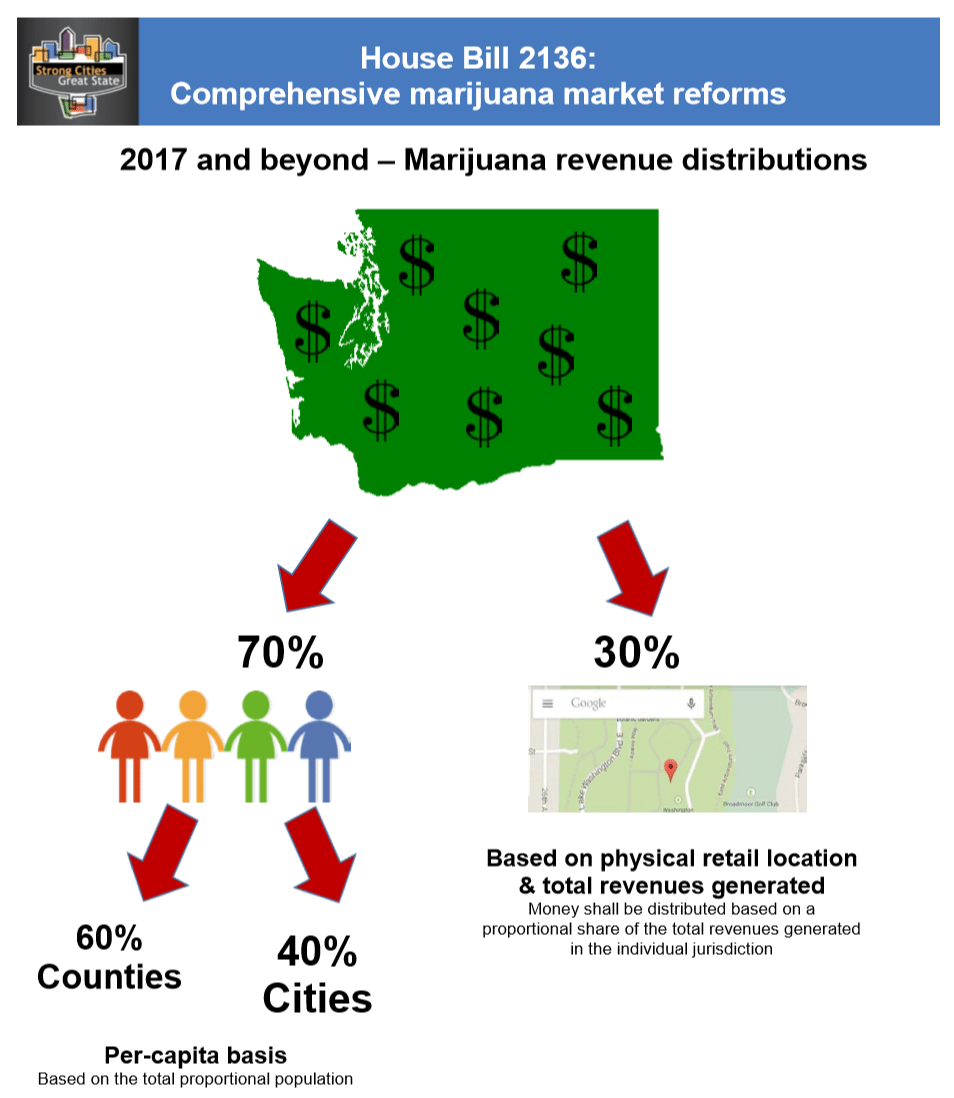

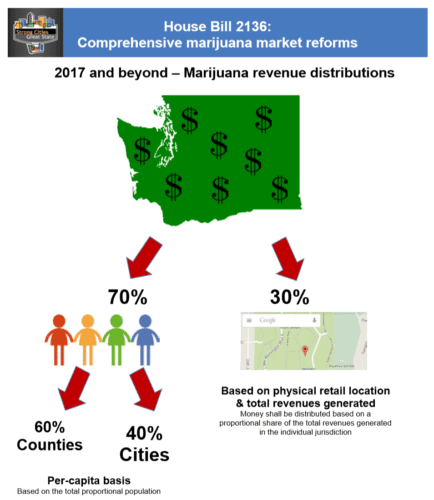

“30 percent will go to counties, cities, and towns where retailers are located, based on the retail sales from stores within each jurisdiction;

70 percent will be distributed to counties, cities, and towns on a per capita basis – but only to jurisdictions that do not prohibit the siting of state-licensed producers, processors, or retailers,” Mikhail Carpenter explained. Carpenter is a representative for the WSLCB. The money is distributed in quarterly payments.

King County has raised over $146 million in excise tax, Grant and Kittitas County over $4 million each. In 2016 and 17, Ellensburg will receive upwards of $65 thousand dollars. Kittitas County will receive about $55 thousand during the same time.

Other counties are receiving similar amounts in 2017 and 17: Grant County gets about $53 thousand, King County is getting about two million, according to WSLCB documents. It may look like King County is getting a larger share, but only because there are millions more people buying cannabis products there. What they’re receiving compared to how much is made is minuscule in comparison.

In part three we will discuss the local government’s role in the excise tax system.